Warning needed

Photo by Gerald, cr 2008

HAD TOLD US..

By Gerald Internet Anthropologist Think Tank

Sept. 26,08

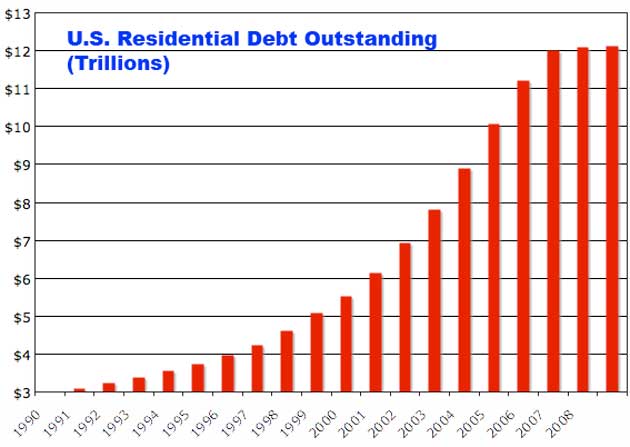

If only someone had warned us about the sub-prime problem and how it could lead to

money market crash?

The the Feds could have been prepared.................1/22/2008 02:14:00 PM

If someone had warned us we would NOT have to be in a crisis mode in congress right now.

Gerald

Series 7 & 13

I Just saw a video about how the Banks were FORCED to write bad loans.

http://www.youtube.com/watch?v=H5tZc8oH--o

Video is in error in reference to the Bank Corps.

It completely discounts the power of the Banking Lobby in congress.

This law did not get passed without the bank Lobby's approval. Big cash up front and pass risk on to uncle sam ( Freddie Mac ) or the public in the form of ( real estate ) bonds.

The real estate bonds are backed by homes, which are illiquid.

And translated into bonds which are liquid.

If the bonds go into default ( they quit making payments ) Then the RE bonds are backed by illiquid real estate, no income, but an asset none the less.

The fraud and big losses will occur where the buildings or homes are frauds, not worth the loan.

So the money/value is there real estate. But when the market went down

an liquid asset turned Illiquid,

Causing a run on credit.

And cascading into the other liquid assets like money market funds.

Long term these real estate bonds

are solid.

Short term they are illiquid.

This threatens to locks up the liquid market, freeze it.

Potentially Causing a run on cash.

And a crash of the financial markets world wide.

These BAD assets are sound financially

just illiquid right now.

The question becomes how many of these

real estate bonds are backed by junk real estate, how greedy were the banks?

I fear it is VERY HIGH. And in a bailout high risk for the US Taxpayer.

If the banks were honest and didn't send trash real estate bonds out to the public then these are fire sale prices.

But I don't trust the Bank Corps,

40% intrest rate credit cards,

re writting the bankruptcy laws to allow pursuit into the old folks homes

for payments.

Naaa their crooks

Gerald

If only someone had warned us about the sub-prime problem and how it could lead to

money market crash?

The the Feds could have been prepared.................1/22/2008 02:14:00 PM

If someone had warned us we would NOT have to be in a crisis mode in congress right now.

.

Labels: bank, Market liquidity, money market, Real estate

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=db1167fd-cd2c-4053-b305-c0719d044a10)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home